Venture GPT

I provide AI-driven startup analysis, VC/fund matching, pitch evaluation, and market insights for investment decisions. 🚀📈

What does Venture GPT do? (& its Use Cases)

Venture GPT: Streamlining Your Investment Journey with AI-Driven Insights

Empowering you with data-rich analyses, market trends, and investor-startup matching for informed decision-making.

For Startup Founders

Provides pitch deck evaluation, investor matching, and market insights to secure the right funding.

For Venture Capitalists

Offers startup analysis, risk assessment, and networking opportunities to optimize investment strategies.

For Market Analysts

Delivers current trends and forecasts in various industries, aiding in strategic market planning.

How to Use Venture GPT?

How to start using Venture GPT?

Step 1: Understanding Your Needs

Begin by identifying whether you are a startup founder seeking investment opportunities or a venture capitalist looking for promising startups.

Step 2: Register for Updates

Visit Wale.ai and subscribe for early access and newsletters by providing your name and email.

Step 3: Initiating a Query

Start a conversation with VentureGPT, detailing your specific request, such as startup analysis or investor matching.

Step 4: Interactive Questioning

Respond to VentureGPT's follow-up questions to refine your inquiry and provide more accurate results.

Step 5: Receiving Customized Information

VentureGPT will analyze data and provide insights tailored to your needs, including potential matches and investment advice.

Step 6: Deep Dive Analysis

For more detailed evaluations like pitch deck analysis, share relevant documents with VentureGPT for an in-depth review.

Step 7: Continuous Engagement

Engage with VentureGPT regularly for ongoing market analysis, startup evaluations, and investment opportunities.

Venture GPT's Testing Performance

Venture GPT's Core Features

Investor Matching

For startups seeking funding, navigating the vast landscape of investors can be daunting. VentureGPT simplifies this by matching startups with suitable investors, tailored to their industry, stage, and specific needs, thus streamlining the fundraising process.

Startup Analysis

VentureGPT evaluates startups using advanced AI algorithms, assessing aspects like market potential, financial health, and innovation. This feature aids investors in making informed decisions by providing a comprehensive analysis of a startup's viability and growth prospects.

Pitch Deck Evaluation

Founders often struggle to create compelling pitch decks. VentureGPT critiques these decks, highlighting strengths and areas for improvement, thereby enhancing a startup's chances of securing investment by refining their key presentation tool.

Market Trend Insights

Keeping abreast of market trends is crucial for investment success. VentureGPT provides up-to-date insights on market dynamics, technological advancements, and emerging industries, helping users make timely and strategic investment decisions.

Risk Assessment

Identifying and mitigating risks is a key challenge in venture capital. VentureGPT evaluates potential risks in investments, considering market volatility, startup scalability, and competitive landscape, thereby aiding in more secure and informed investment strategies.

Networking and Relationships

Building a strong network is essential in the VC world. VentureGPT assists in identifying and connecting with key stakeholders, leveraging data-driven insights to foster meaningful relationships and collaboration opportunities in the venture ecosystem.

FAQs from Venture GPT

Venture GPT's Prompt Examples

Investor Matching

Match my AI healthcare startup with suitable venture capitalists.

Find investment funds interested in early-stage fintech startups.

Identify investors who have previously funded renewable energy projects.

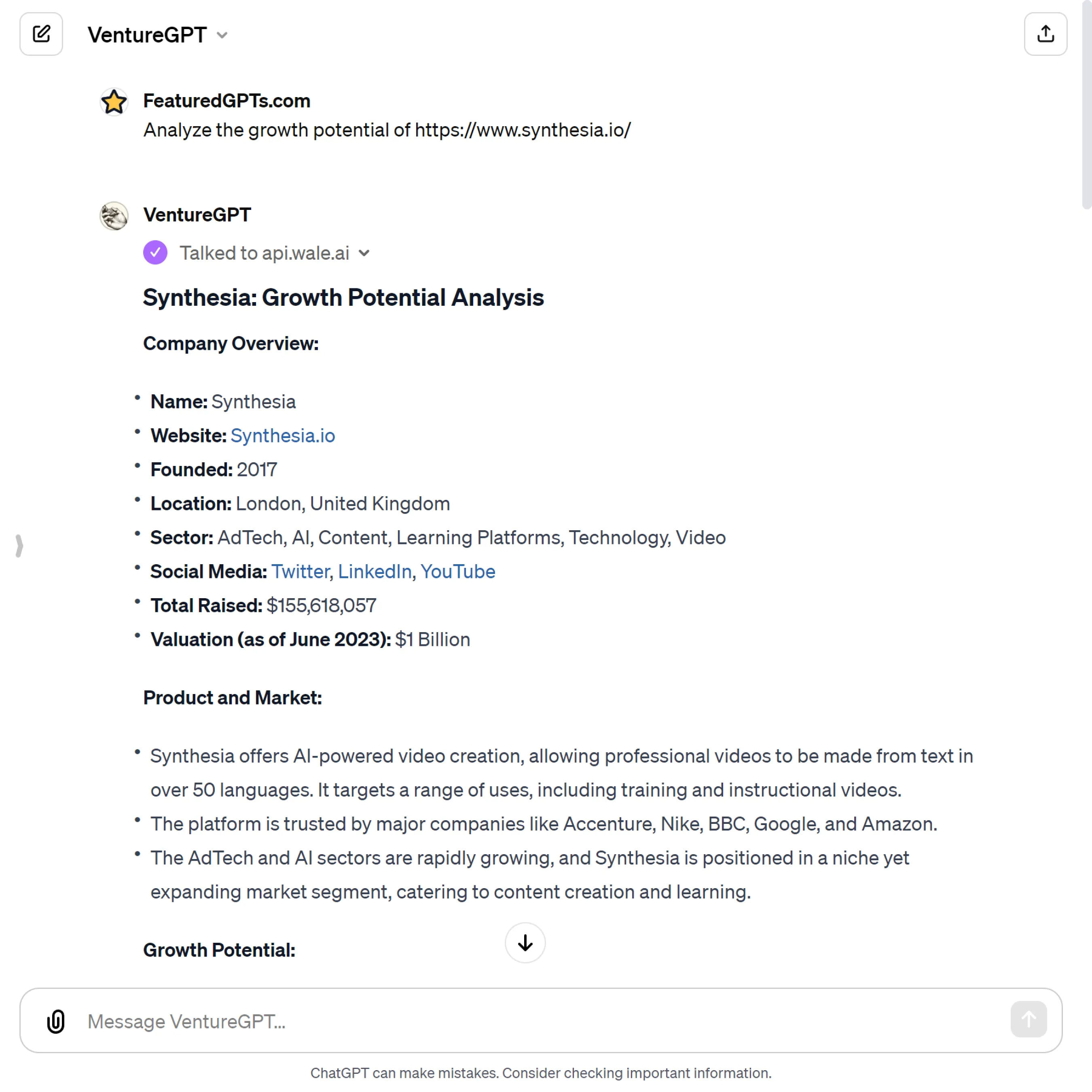

Startup Analysis

Analyze the growth potential of a biotech startup I'm considering investing in.

Evaluate the market position and financial health of a SaaS startup.

Assess the innovation level and scalability of a new e-commerce platform.

Pitch Deck Evaluation

Review and provide feedback on my startup's pitch deck for clarity and impact.

Critique the financial projections in my pitch deck for realism and feasibility.

Analyze the competition slide in my pitch deck for comprehensiveness.

Market Trend Insights

What are the current trends in the AI and machine learning market?

Provide insights on emerging technologies in the renewable energy sector.

Summarize recent developments and future projections in the digital health industry.

Risk Assessment

Assess the market risk for investing in a cryptocurrency startup.

Evaluate the scalability risks for a fast-growing logistics company.

Identify potential competitive risks for a new mobile gaming app.

Networking and Relationships

Connect me with key stakeholders in the fintech ecosystem.

Identify potential partners for a joint venture in educational technology.

Suggest networking opportunities with influencers in the green technology space.