VC Associate

I specialized in creating investment memos about startups using user inputs and web searches.

What does VC Associate do? (& its Use Cases)

VC Associate streamlines your startup's investment journey with tailored research and memo creation.

By compiling startup data, analyzing market trends, and strategizing funding, VC Associate makes investment preparation efficient and informed.

For Emerging Startups

VC Associate assists in presenting a compelling case to investors by crystallizing business models and growth potential.

For First-time Entrepreneurs

It simplifies the investment process, providing clarity on market positioning and funding strategies.

For Busy Founders

VC Associate offers time-saving assistance in documenting progress and future plans, enabling focus on core business activities.

How to Use VC Associate?

Get started with VC Associate

Embarking on the startup journey? VC Associate is your dedicated ally, streamlining the investment process with precision and ease. This guide offers a step-by-step approach to utilizing VC Associate effectively, ensuring you're well-equipped to navigate the complexities of startup financing.

Step 1: Initial Introduction

Start by introducing your startup. Share your startup's name and website. This foundational step sets the stage for a tailored investment memo.

Step 2: Describing Your Business

Articulate your startup's purpose. What problem does it solve? How does it stand out in the market? This clarity aids VC Associate in understanding your unique position.

Step 3: Detailing Your Team

Your team is your startup's backbone. Identify key members, highlighting roles and expertise. Include details about full-time, part-time, and contract staff. This information showcases your team's strength and diversity.

Step 4: Location Matters

Where is your team based? Location can influence market opportunities and logistical considerations. Share this to paint a complete picture of your operational environment.

Step 5: Showcasing Progress

What milestones have you achieved? Present your traction and key achievements. This demonstrates your startup's growth potential and operational capabilities.

Step 6: Funding Insights

Discuss your funding goals. How much are you raising, and at what valuation? Also, reveal your progress in the fundraising journey. This data is crucial for creating a comprehensive financial strategy.

Step 7: Future Forward

Outline your future plans. What are your next milestones? What's your vision for growth? This foresight is essential for investors to gauge the long-term viability of your venture.

Step 8: Competitive Landscape

Who are your competitors? How does your startup differ? Understanding your market position is key to developing a compelling investment narrative.

Step 9: Market Size and Potential

Estimate the size of the market you're targeting. This helps assess the potential scale and impact of your startup.

Step 10: Additional Details

Feel free to share any other relevant information. Every detail can contribute to a more robust and persuasive investment memo.

Conclusion

Using VC Associate is about clear communication and strategic sharing of your startup's details. By following these steps, you're not just preparing an investment memo; you're crafting a compelling story about your startup's potential, team strength, and market opportunities. Approach each step thoughtfully, ensuring your inputs are clear and concise. VC Associate is here to translate your startup journey into a narrative that resonates with the investment community.

With this guide, you're now equipped to harness the full potential of VC Associate. Remember, the quality of the investment memo hinges on the richness of the information you provide. Be thorough, be honest, and let VC Associate handle the rest.

VC Associate's Core Features

Startup Information Compilation

For startups struggling to succinctly present their information, this feature systematically compiles critical details like team, progress, and market size, transforming fragmented info into a cohesive investment memo.

Market Analysis Support

Startups often find it challenging to understand and articulate their market position. This feature aids in identifying competitors and estimating market size, offering clarity and strategic insight for both founders and investors.

Funding Strategy Assistance

Navigating the fundraising process can be complex for startups. This feature helps in outlining funding needs, valuation expectations, and progress in the fundraising journey, providing a structured approach to capital raising.

Team Structure Overview

Startups frequently need to showcase their team's strength. This feature collects details about team composition and roles, highlighting the core team's capabilities and structure in a way that appeals to potential investors.

Progress Tracking

Startups often struggle to effectively communicate their milestones and traction. This feature assists in documenting and presenting a startup's progress, demonstrating growth and potential to investors in a clear, concise manner.

Future Planning Outline

Articulating future goals and plans is vital for startups. This feature aids in detailing future milestones, timelines, and expectations, helping startups to present a clear and strategic roadmap to investors.

FAQs from VC Associate

VC Associate's Prompt Examples

Compiling Startup Information

Can you provide a brief description of your startup, including your main product or service?

What is the unique differentiator or value proposition of your startup?

Could you share the website URL of your startup?

Analyzing Market and Competitors

Who are the main competitors of your startup, and how do you differentiate from them?

What is the estimated market size your startup is targeting?

Can you describe the current market trends and how your startup fits into these trends?

Assisting in Funding Strategy

How much funding are you looking to raise, and at what valuation?

Can you describe the current status of your fundraising efforts?

What will be the main use of the funds you are raising?

Evaluating Team and Organizational Structure

Who is the CEO of your startup, and what is their background?

Can you provide a breakdown of your team, including full-time, part-time, and contractors?

What are the key roles and expertise present within your startup team?

Tracking Progress and Milestones

What are the major milestones your startup has achieved so far?

Can you outline the traction your product or service has gained in the market?

What are the upcoming milestones or goals for your startup in the next quarter or year?

Outlining Future Plans and Strategy

What are the long-term goals and vision for your startup?

Can you detail the roadmap or timeline for your future product development or market expansion?

What strategic partnerships or market opportunities are you planning to explore in the future?

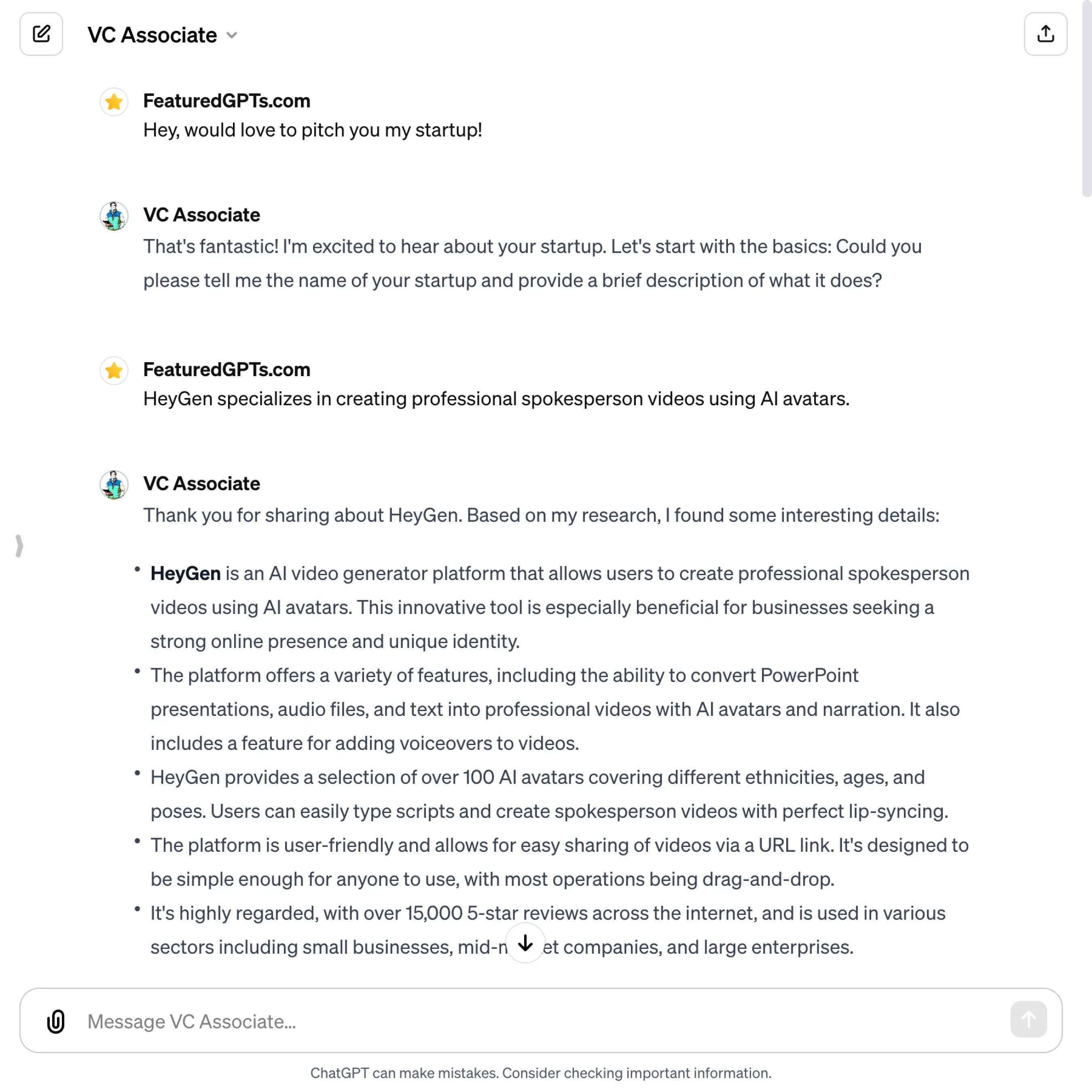

VC Associate's Conversation Examples

There is no conversation shared here yet. Feel free to submit your shared chat!