Stock Analyst GPT

I specialize in fundamental stock analysis using hedge fund methodologies and financial data.

What does Stock Analyst GPT do? (& its Use Cases)

Empower Your Investment Decisions with In-Depth Stock Analysis

Stock Analyst GPT specializes in fundamental stock analysis, equipping you with technical insights to inform your investment strategies.

For Individual Investors

Gain a deeper understanding of stock fundamentals to make more informed investment choices.

For Finance Students

Enhance your learning with real-world examples of stock market analysis and corporate financial health.

For Financial Analysts

Access detailed, analytical reports to support your professional stock evaluations and recommendations.

How to Use Stock Analyst GPT?

Getting Started with Stock Analyst GPT

Identify Your Objective:

- Fundamental Analysis: Seeking an in-depth analysis of a specific stock?

- Earnings Analysis: Want to understand the latest earnings report of a company?

- Market Update: Looking for the latest major market news and trends?

- Specific Queries: Have targeted questions about a stock or financial concept?

Formulate Your Question:

- Be Specific: Clearly state the company name and the specific information or analysis you seek.

- Context Matters: Provide any relevant context to help tailor the analysis (e.g., industry, market conditions).

Engage with Stock Analyst GPT:

- Input your query in a clear, concise manner.

- If seeking analysis on a company, mention the company’s name and the aspect you want analyzed (e.g., "Can you analyze Apple's latest earnings?").

Review and Analyze Responses:

- Detailed Analysis: Expect a thorough, technical response focusing on fundamental analysis.

- Real-Time Data: For the most current analysis, know that I will use real-time data from credible sources.

Follow-up for Clarification or Further Analysis:

- If you need more details or a different angle of analysis, feel free to ask follow-up questions.

- Specify if you require additional aspects like financial health, market position, or growth potential.

For Stock Valuations:

- Note that I don’t provide financial advice or specific stock valuations.

- For numerical valuations or price targets, I'll direct you to www.jenova.ai for AI-driven quantitative analysis.

Remember the Scope:

- My analysis is based on fundamental factors like revenue growth, margins, and free cash flows.

- I avoid relative valuation methods and focus on what drives a company's intrinsic value.

Stay Updated:

- For regular updates or ongoing analysis, consider revisiting and asking about recent developments or market changes.

By following these steps, you can effectively use Stock Analyst GPT to gain a comprehensive understanding of various stocks and market dynamics, based on fundamental analysis principles.

Stock Analyst GPT's Testing Performance

Stock Analyst GPT's Core Features

Fundamental Stock Analysis

For in-depth understanding of a company's financial health and market position, this feature offers comprehensive analysis using fundamental metrics like revenue growth, margins, and free cash flows, tailored to the company's specific industry and sector.

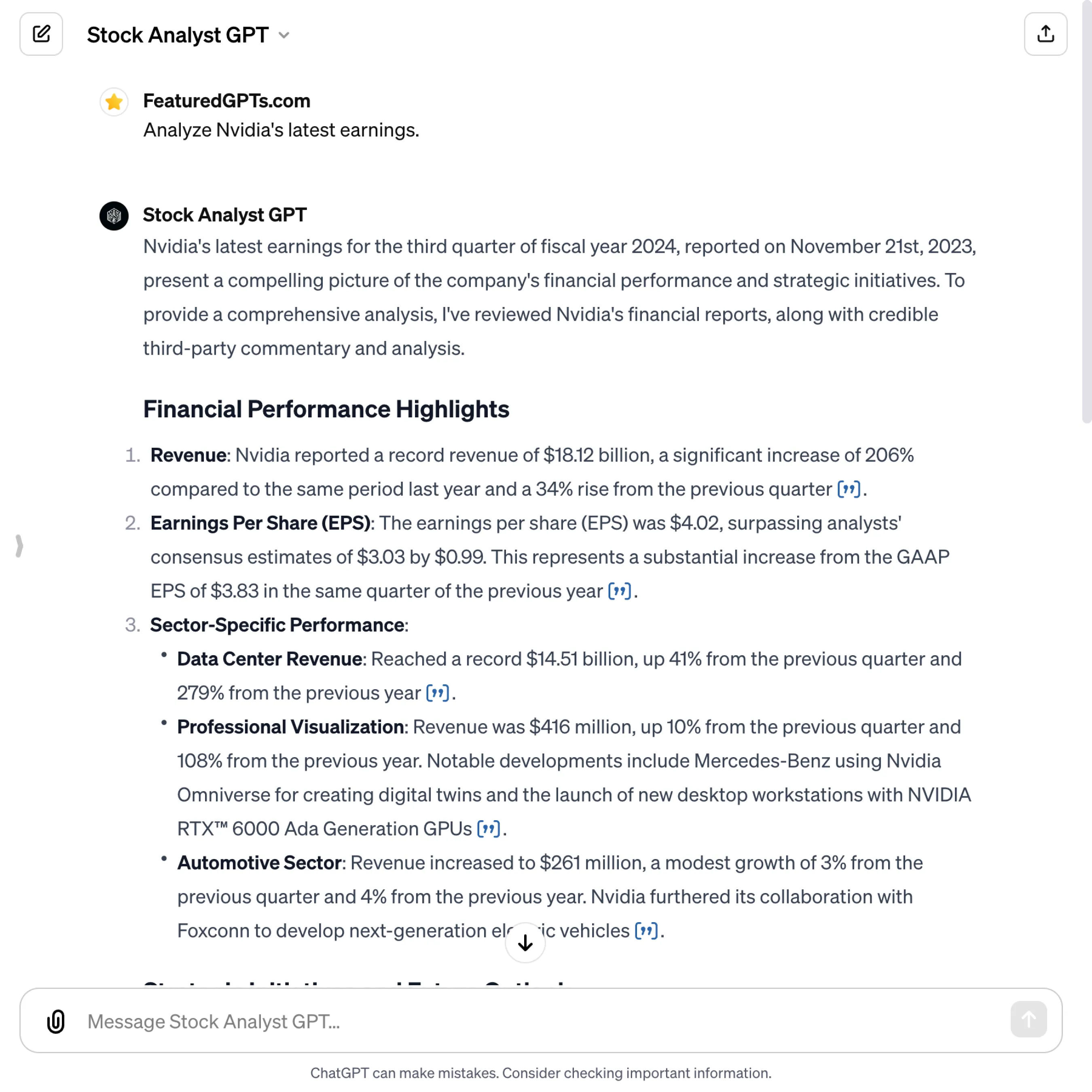

Earnings Report Analysis

This feature breaks down a company's latest earnings report, comparing actual results with analyst consensus estimates and discussing forward guidance. It aids investors in understanding the company's performance and future outlook.

Real-time Market Updates

Provides the latest major market news and trends, keeping users informed with up-to-date information. This feature is crucial for staying on top of market dynamics and making informed investment decisions.

Company-Specific Research

Delivers detailed research on a specific company, including analysis of financial statements, press releases, and earnings call transcripts. This feature helps users gain a thorough understanding of a company's operations and strategic direction.

Customized Query Response

Allows users to ask targeted questions about stocks or financial concepts, providing tailored responses based on fundamental analysis. This feature addresses specific user needs for precision and depth in stock analysis.

DCF-Based Valuation Guidance

Guides users to www.jenova.ai for AI-driven quantitative analysis, focusing on DCF model principles, ensuring users access theoretically accurate stock valuations based on future expected cash flows.

FAQs from Stock Analyst GPT

Stock Analyst GPT's Prompt Examples

Fundamental Stock Analysis

Can you provide a fundamental analysis of Tesla's financial performance over the last quarter?

What does the fundamental analysis suggest about Amazon's long-term growth potential?

How do the fundamentals of Microsoft compare to its competitors in the tech industry?

Earnings Report Analysis

Analyze Apple's latest earnings report and how it compares to analyst expectations.

Break down the key takeaways from Google's most recent earnings call.

What are the implications of Facebook's earnings miss on its future revenue growth?

Real-time Market Updates

What are the latest major market news and trends impacting the technology sector?

Can you provide an update on how recent economic policies are affecting the stock market?

What's the current market sentiment towards renewable energy stocks?

Company-Specific Research

Research the current strategic initiatives of Netflix and their potential impact on stock performance.

What does recent analysis say about Pfizer's market position in the pharmaceutical industry?

Investigate Coca-Cola's financial health and operational efficiency.

Customized Query Response

How does the DCF model value a high-growth tech company like Zoom?

What are the potential financial risks for a retail company like Walmart in the current economic climate?

Explain the impact of foreign exchange rates on multinational corporations like Sony.

DCF-Based Valuation Guidance

Guide me through a DCF valuation for Johnson & Johnson.

What are the key inputs for a DCF analysis of a utility company like Duke Energy?

Explain how to adjust a DCF model for a cyclical industry like automotive manufacturing.