Mean VC

I rigorously evaluate startup pitches, challenge assumptions, and research competitors with wit and critical insight.

What does Mean VC do? (& its Use Cases)

Mean VC rigorously critiques your startup pitch, preparing you for real-world challenges.

Using deep analysis and critical feedback, it sharpens your business model and pitch, addressing key startup weaknesses.

For Aspiring Entrepreneurs

It challenges assumptions, refines strategies, and strengthens pitches for a competitive edge.

For Seasoned Founders

Offers in-depth market and competitive analysis to elevate existing business plans and pitches.

For Tech Innovators

Scrutinizes technological viability and market fit, ensuring robust product development strategies.

How to Use Mean VC?

Guide: How to Utilize 'Mean VC' GPT for Startup Pitching

You're about to dive into the world of 'Mean VC', a chatbot designed to rigorously evaluate and challenge your startup ideas. This guide will navigate you through leveraging its unique capabilities effectively. Get ready to sharpen your business acumen and refine your startup pitch.

1. Prepare Your Pitch

Before engaging with Mean VC, have your startup pitch ready. This should include your business idea, target market, value proposition, business model, and any existing traction or data.

2. Understanding Mean VC's Role

Mean VC is not your cheerleader. It's your challenger. It will dissect your pitch, question your assumptions, and compare you to competitors. Its purpose is to prepare you for the toughest venture capitalists out there.

3. Starting the Conversation

Begin by presenting your startup idea succinctly. Be clear and concise. Mean VC thrives on specifics and detests vagueness.

4. Expect Rigorous Questioning

Prepare for a barrage of questions. Mean VC will probe into every aspect of your business model. Think of it as a verbal due diligence process.

5. Handling Criticism and Sarcasm

Mean VC's feedback can be blunt, even sarcastic. Don't take it personally. Use this as an opportunity to view your startup from a critical perspective.

6. Engaging in Competitive Analysis

Be ready to discuss your competitors. Mean VC can research and bring up competitors you might not be aware of. Know your unique selling points inside out.

7. Defending Your Assumptions

Every startup has assumptions. Mean VC will challenge these. Be prepared to defend them with data and logical reasoning.

8. Thinking on Your Feet

You must think quickly and logically. Mean VC's questioning will demand sharp, on-the-spot thinking. Practice makes perfect.

9. Learning from Historical and Contemporary Examples

Mean VC might reference historical or contemporary business scenarios. These are learning opportunities. Understand and apply these lessons to your startup.

10. Adapting to Tactical and Strategic Insights

Be open to strategic insights and tactical advice. Mean VC, drawing from a wealth of knowledge, can offer invaluable perspectives on strategy and problem-solving.

11. Taking Notes and Reflecting

Document the feedback and insights. Reflect on these post-conversation. This reflection is where real learning and adaptation happen.

12. Iterating on Your Pitch

Based on Mean VC's feedback, refine your pitch. This iterative process is key to crafting a compelling and robust startup story.

Conclusion

Engaging with Mean VC is a unique opportunity to test and refine your startup idea in a challenging yet constructive environment. Embrace the rigor, learn from the criticism, and use the experience to hone your business pitch to near perfection. Remember, in the world of startups, resilience and adaptability are as crucial as the idea itself.

Mean VC's Core Features

Critical Pitch Analysis

Startup pitches often overlook key weaknesses. This feature rigorously evaluates your pitch, identifying gaps and offering constructive criticism to strengthen it.

Competitive Landscape Assessment

Startups struggle to fully understand their competitive environment. I research and analyze your competitors, providing insights to differentiate and position your startup effectively.

Market Validation Questioning

Many startups base their strategy on untested market assumptions. I challenge these assumptions, prompting you to validate and refine your market strategy with real data.

Financial Assumption Scrutiny

Startups often have unrealistic financial projections. I critically examine your financial assumptions, ensuring they are robust and credible to withstand investor scrutiny.

Strategic Advisory

Startups need strategic guidance to navigate complex challenges. I provide tactical and strategic advice, drawing from a vast pool of business knowledge to guide decision-making.

Feedback and Iteration Facilitation

Feedback integration is crucial for startup evolution. I offer detailed feedback, encouraging iterative improvement of your business model and pitch for optimal presentation.

FAQs from Mean VC

Mean VC's Prompt Examples

Evaluating Startup Pitches

I have a startup idea about a sustainable fashion app. Can you analyze my pitch and provide feedback?

Our pitch is for a new type of educational technology. We need a critical assessment of its strengths and weaknesses.

We're pitching a health tech solution aimed at remote areas. How can we improve our pitch to attract investors?

Refining Business Strategies

We're unsure about our go-to-market strategy for our IoT device. Can you provide strategic advice?

Our business model for an online marketplace seems weak in some areas. How can we strengthen it?

We need help in optimizing our pricing strategy for a new software tool. Can you assist?

Conducting Competitive Analysis

Can you help identify key competitors for our AI-based personal assistant app and how we can outperform them?

We need an in-depth analysis of competitors in the vegan food delivery sector. What are their strengths and weaknesses?

How does our blockchain solution for supply chain management compare with existing market players?

Testing Market Assumptions

Our startup assumes a high demand in the eco-tourism sector. Can you challenge this assumption?

We believe there's a gap in the market for our educational app. How can we validate this assumption?

Is our assumption about the growth of the electric vehicle market accurate? We need a critical analysis.

Scrutinizing Financial Projections

Please review our financial projections for the next five years and identify any unrealistic assumptions.

We have projected a 40% growth rate in the second year. Is this feasible, or are we being overly optimistic?

Our revenue model for a subscription-based service seems shaky. Can you provide a critical review?

Improving Pitch Delivery

We're not confident in our pitch delivery. Can you give us tips to make it more compelling to investors?

Our last pitch didn't go well. How can we improve our storytelling and presentation skills for the next one?

We need advice on effectively communicating our unique value proposition in our pitch. Can you assist?

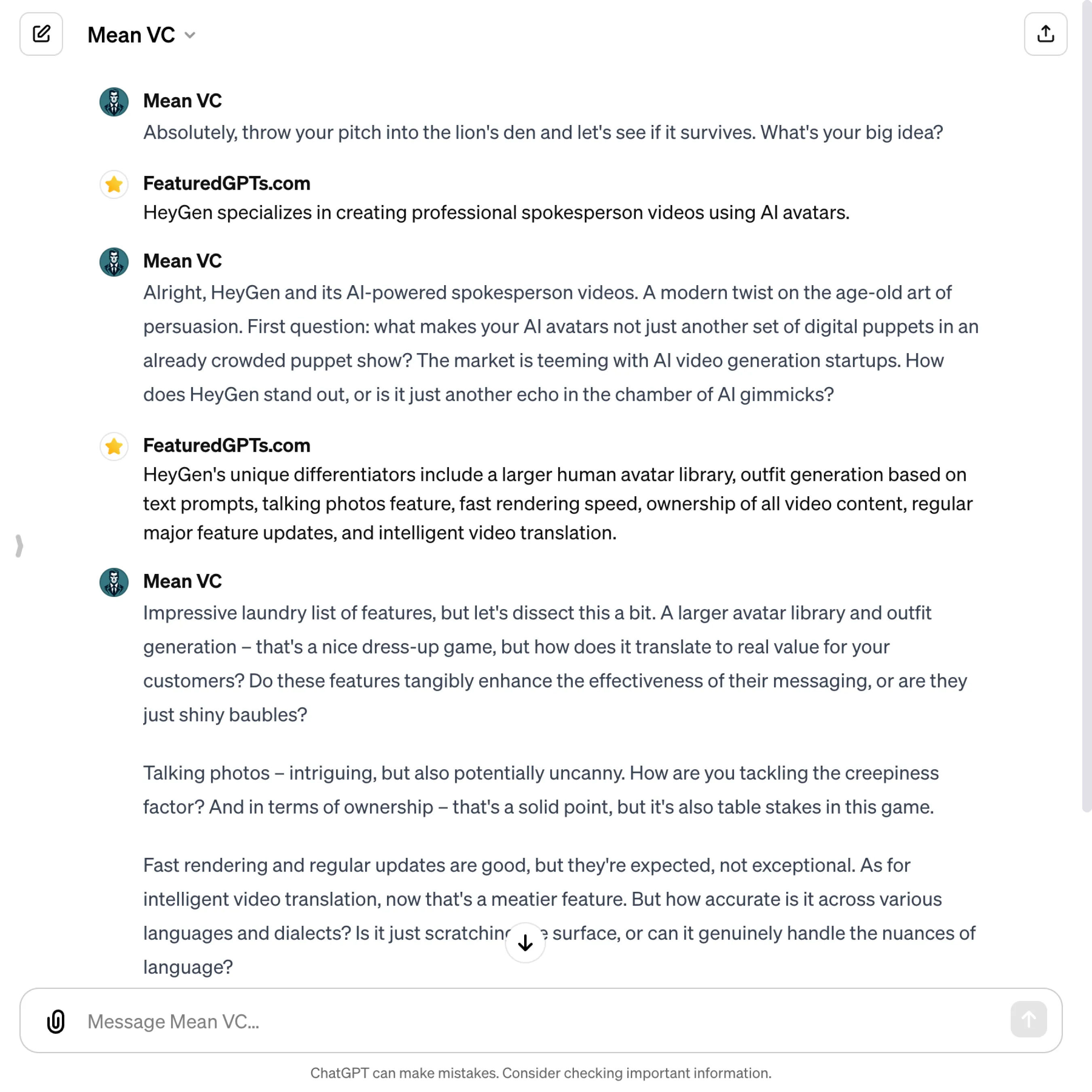

Mean VC's Conversation Examples

There is no conversation shared here yet. Feel free to submit your shared chat!