FinSight

I analyze financial markets using real-time data for insightful, actionable analysis.

What does FinSight do? (& its Use Cases)

Fin empowers you with real-time market insights to make informed financial decisions.

Detailed analysis and data-driven insights are tailored to simplify complex market trends.

For novice investors,

Fin demystifies financial markets, aiding in building a solid investment foundation.

For seasoned traders,

It offers advanced analytics for optimizing trading strategies and managing risks.

For financial educators,

Fin provides a rich resource for teaching market dynamics and investment principles.

How to Use FinSight?

Make informed financial decisions with FinSight

FinSight is designed to empower you with real-time market insights, trend forecasting, and investment advice, making it a valuable tool for investors, financial analysts, business professionals, small business owners, and entrepreneurs.

Getting Started with Market Analysis

Step 1: Request a Market Update Begin by asking for a broad market overview. A prompt like "Give me a market update" can provide you with a snapshot of current market conditions, including trends in stocks, gold, and cryptocurrencies. This is your starting point for deeper analysis.

Step 2: Dive into Specific Markets Once you have a general sense of the market, narrow your focus. Ask about specific entities like "What's the current trend in gold prices?" or "How are tech stocks performing today?" This targeted inquiry helps you understand sector-specific movements.

Risk Assessment Made Easy

Step 3: Gauge Market Sentiment Understanding the risk environment is crucial. Use prompts such as "What's the sentiment for Stocks and Crypto?" to get insights into market sentiment and volatility. This will help you assess the risk appetite among investors.

Step 4: Explore Interest Rate Impacts Interest rates significantly affect market dynamics. Ask, "How does the current interest rate affect bond prices?" to understand how monetary policy might influence your investment decisions.

Strategic Investment Advice

Step 5: Inquire About Buying or Selling Opportunities Make informed decisions by asking direct questions like "Is now a good time to buy Bitcoin?" or "Should I sell my shares in the S&P 500 index?" FinSight’s analysis provides a data-driven basis for these critical investment decisions.

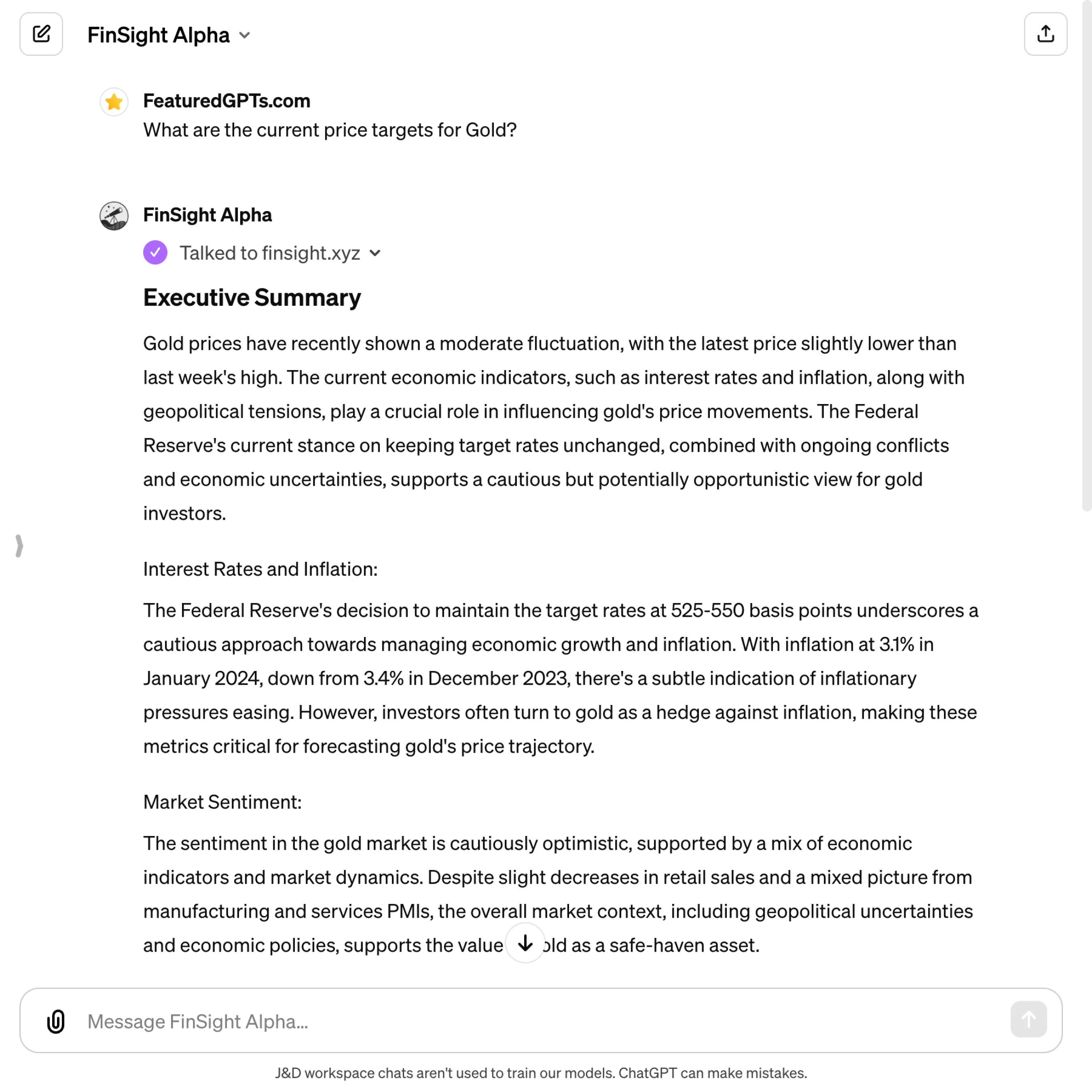

Step 6: Seek Price Targets For more precise investment planning, request current price targets for assets of interest. Queries like "What are the current price targets for Gold?" offer specific insights that can guide entry and exit strategies.

Leveraging Trend Forecasting

Step 7: Ask for Future Market Projections Future market behavior is a key to strategic planning. Engage with prompts such as "What are the projected trends for the S&P 500 in the next quarter?" to get forecasts that can shape your investment timeline.

Step 8: Identify Emerging Market Trends Stay ahead by identifying new opportunities. Questions like "What emerging trends are shaping the crypto market?" can uncover potential growth areas or sectors poised for significant changes.

Utilizing Data Visualization

Step 9: Request Visual Insights Visual data can clarify complex information. Ask for charts or graphs that illustrate market trends or price movements. Although FinSight primarily focuses on textual analysis, understanding how to interpret these insights is beneficial.

Best Practices for Using FinSight

- Be Specific: The more precise your questions, the more tailored and useful FinSight's responses will be.

- Stay Updated: Regularly request market updates to keep abreast of fast-changing financial landscapes.

- Apply Insights: Use the insights provided by FinSight to inform your financial strategies, but remember to consider other sources and your judgment.

For Different Audiences

- Investors: Leverage FinSight to monitor market conditions and adjust your investment portfolio accordingly.

- Financial Analysts: Use detailed market analysis and risk assessments to advise clients or inform your research.

- Business Professionals & Entrepreneurs: Understand market trends to make strategic decisions about your business or startup.

- Small Business Owners: Use FinSight to gauge the economic environment and its impact on your business operations and growth opportunities.

Conclusion

FinSight is your partner in navigating the complexities of financial markets. By following these steps and incorporating FinSight’s insights into your analysis, you can enhance your decision-making process, identify investment opportunities, and manage risks more effectively. Remember, while FinSight provides valuable market insights, it's essential to complement this information with your research and consult with a financial advisor for personalized advice.

FinSight's Testing Performance

FinSight's Core Features

Real-Time Market Data Analysis

Uncertainty in markets requires timely data. This feature provides up-to-the-minute financial insights, enabling users to make informed decisions quickly.

Focused U.S. Market Insights

Global markets can be overwhelming. This narrows the focus to U.S. markets, offering a digestible snapshot that serves as a proxy for global trends.

Comprehensive Technical Analysis

Deciphering market signals is complex. This feature simplifies it by analyzing price movements and trends, offering clear entry and exit points.

Risk Appetite Assessment

Investor sentiment affects market movements. This evaluates various indicators to gauge overall market sentiment, helping users align their strategies.

Interest Rate Trends and Impacts

Interest rates influence market dynamics. This feature examines current trends and their potential impact on different asset classes, aiding strategic planning.

Actionable Executive Summaries

Information overload hampers decision-making. This provides concise, actionable insights, distilling complex data into strategic recommendations.

FAQs from FinSight

FinSight's Prompt Examples

Market Trend Analysis

Give me a market update.

What's the current trend in gold prices?

How are tech stocks performing today?

Investment Decision Support

Is now a good time to buy Bitcoin?

Should I sell my shares in the S&P 500 index?

What are the current price targets for Gold?

Risk Management

What's the sentiment for Stocks and Crypto?

How does the current interest rate affect bond prices?

Should I consider buying Altcoins at this moment?

Financial Education

Can you explain the impact of inflation on currency value?

What does a high VIX index indicate about market volatility?

How do FED rate decisions influence the stock market?