DefiLlama

I analyze DeFi stats and provide current and historical stats on DeFi protocols and blockchains.

What does DefiLlama do? (& its Use Cases)

DeFiLlama offers DeFi analytics to help you make informed investment decisions.

Access real-time data on TVL, protocol fees, and yield farming opportunities.

For investors exploring DeFi,

It simplifies tracking and comparing protocol performances.

For financial analysts,

It provides deep market insights and trend analysis.

For DeFi enthusiasts,

It identifies emerging opportunities and high-yield pools.

How to Use DefiLlama?

Guide: How to Use DeFiLlama for DeFi Analytics and Insights

DeFiLlama is designed to simplify your journey through the complex landscape of Decentralized Finance (DeFi). Whether you're a beginner or an experienced DeFi enthusiast, this guide will walk you through the process of using DeFiLlama effectively. Let’s dive in.

Getting Started

First things first, understand what DeFiLlama offers. At its core, DeFiLlama is your go-to for analyzing DeFi statistics, including Total Value Locked (TVL), protocol fees, revenue, and more. It's built to provide you with real-time and historical data across various DeFi protocols and blockchains.

Navigating DeFi Data

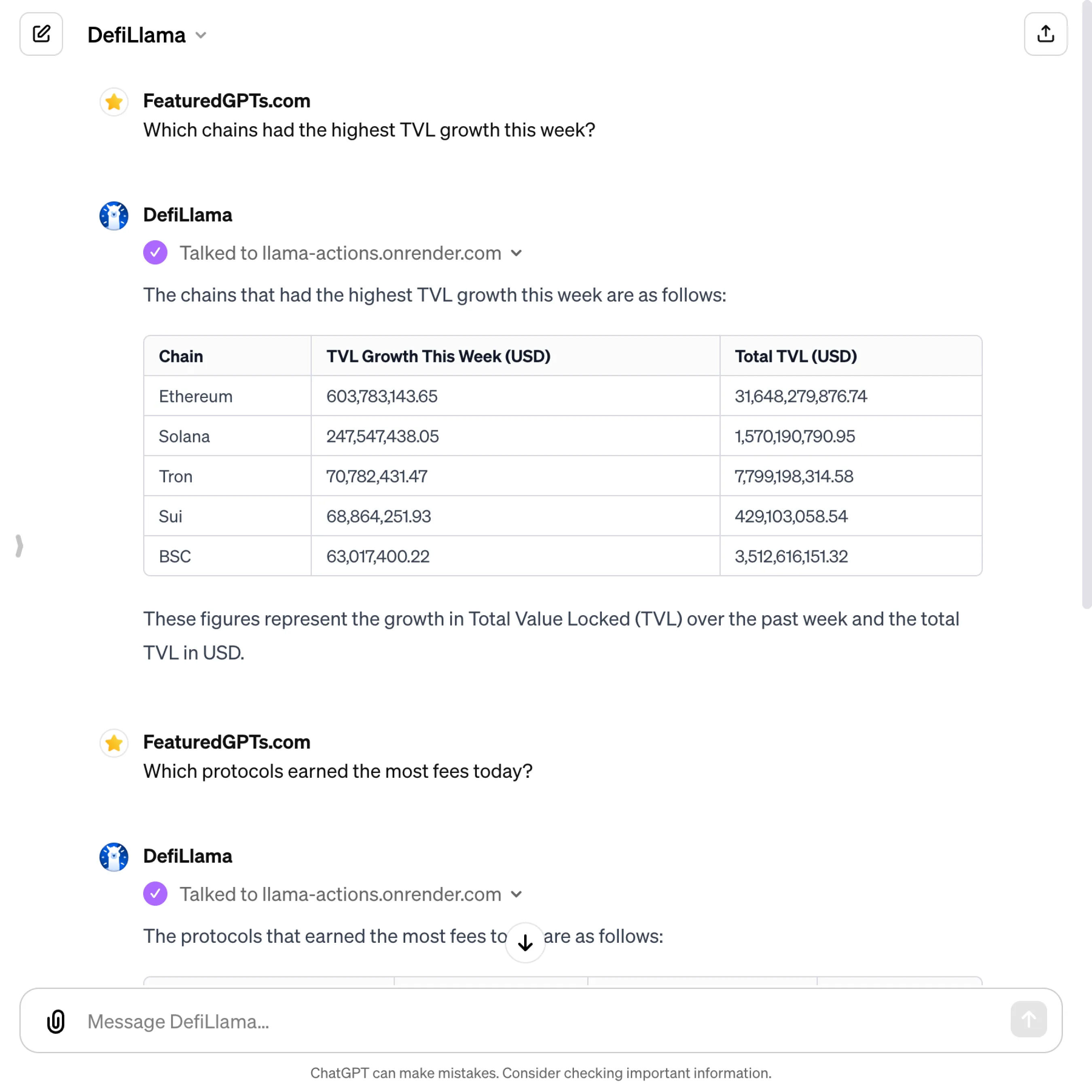

Understanding TVL: Total Value Locked is a crucial metric in DeFi, representing the total capital held within the protocols. To view TVL and other relevant statistics:

- Use the API functionalities to query data on specific protocols by name.

- Explore trends in TVL over different time frames—hour, day, or week.

Protocol Fees and Revenue: Knowing how much a protocol earns can be telling of its utility and popularity.

- Query the API to get the fees earned by a protocol within specified periods.

- Compare revenue data to gauge a protocol’s performance and its appeal to users.

Market Analysis:

- Leverage the tool to view the top gainers and losers in TVL, giving you insights into which protocols are on the rise or experiencing declines.

- Utilize historical TVL data to track the growth trajectory of your interested protocols.

Exploring Chains and L2s: If you're interested in the broader ecosystem, including Ethereum, Binance Smart Chain, Polygon, and others:

- Access TVL data for specific chains or L2s to understand their market position.

- Analyze chain TVL changes over time to spot trends.

Utilizing Uploaded DeFi Reports

For deeper insights:

- Upload DeFi reports to get analyzed content, summaries, and key insights.

- Use these analyses to understand complex market dynamics, protocol performances, and industry trends.

Actionable Strategies

- Set Clear Goals: Know what you're looking for. Whether it's identifying high-growth protocols or understanding market trends, having clear objectives will guide your queries.

- Regular Monitoring: Keep tabs on the protocols and chains you're interested in. Regularly check their TVL, fees, and revenue to stay ahead of market movements.

- Comparative Analysis: Don’t just focus on one protocol or chain. Compare data across several to get a comprehensive view of the market.

DefiLlama's Testing Performance

DefiLlama's Core Features

Real-Time Protocol TVL

Tracks the current Total Value Locked in DeFi protocols, enabling investors to measure protocol liquidity and stability in real-time.

Historical TVL Data

Provides access to past TVL data, offering insights into the growth trends and performance history of DeFi protocols over time.

Protocol Fees Analysis

Analyzes the fees generated by protocols, helping users identify the most lucrative and user-engaged platforms in the DeFi space.

Chain and Layer 2 TVL Metrics

Offers detailed TVL statistics for various blockchains and Layer 2 solutions, highlighting the distribution and flow of liquidity across the ecosystem.

Top Gainers and Losers

Identifies protocols with the most significant TVL changes, guiding users towards high-potential investments or alerting them to declining projects.

Yield Farming Opportunities

Curates the top yielding pools and opportunities, enabling yield farmers to maximize returns by allocating resources to the most rewarding options.

FAQs from DefiLlama

DefiLlama's Prompt Examples

Market Analysis

What is the current TVL of Uniswap and how has it changed over the past month?

Show me the top gainers and losers in TVL over the past week.

Can you provide a comparison of fees generated by Aave vs. Compound for the last quarter?

Investment Decision Support

Identify the DeFi protocols with the highest yield farming returns in the past month.

What are the historical performance trends of the top 5 DeFi protocols by TVL?

List the DeFi platforms on Ethereum with the most significant increase in protocol fees year-to-date.

Trend Spotting and Analysis

What emerging DeFi categories are gaining the most TVL traction this quarter?

Analyze the impact of The Merge on Ethereum's TVL and protocol activities.

Highlight the growth of cross-chain bridges by net flow volume in the last six months.